Death is such a grounding fear among humans because everyone knows that it is inevitable and unexpected–we see this first hand upon news of deadly disasters, tragedies and freak accidents, where people exclaim “new fear unlocked” on social media, because it is, indeed, a fear to unlock. We’ve seen this play out at the height of the pandemic, when we were bombarded with tragic news left and right, on a daily basis, which caused a lot of us to suddenly have the prudence to create Plan Bs of our own. Luckily for us, we have insurance firms to teach us all how we can better prepare in any case (and not just because advice like this are inherently connected to their core services).

But perhaps this part of the whole selling and getting insurance plans needs to be pointed out: Insurance agents do not have to resort to shockvertising (shock advertising or shock marketing) in order to convince people they need insurance coverage.

Shock advertising, according to handy-dandy Wikipedia, is designed principally to break through the advertising “clutter” to capture attention. This form of advertising is often controversial, disturbing, explicit and crass, and may not only offend but can also frighten as well, using scare tactics and elements of fear to sell a product or deliver a public service message.

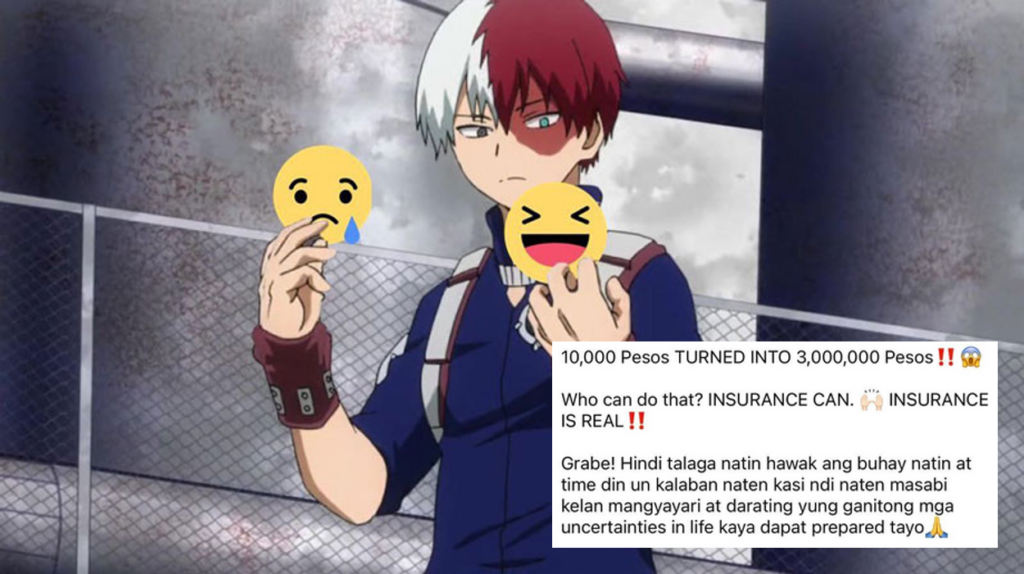

Case in point:

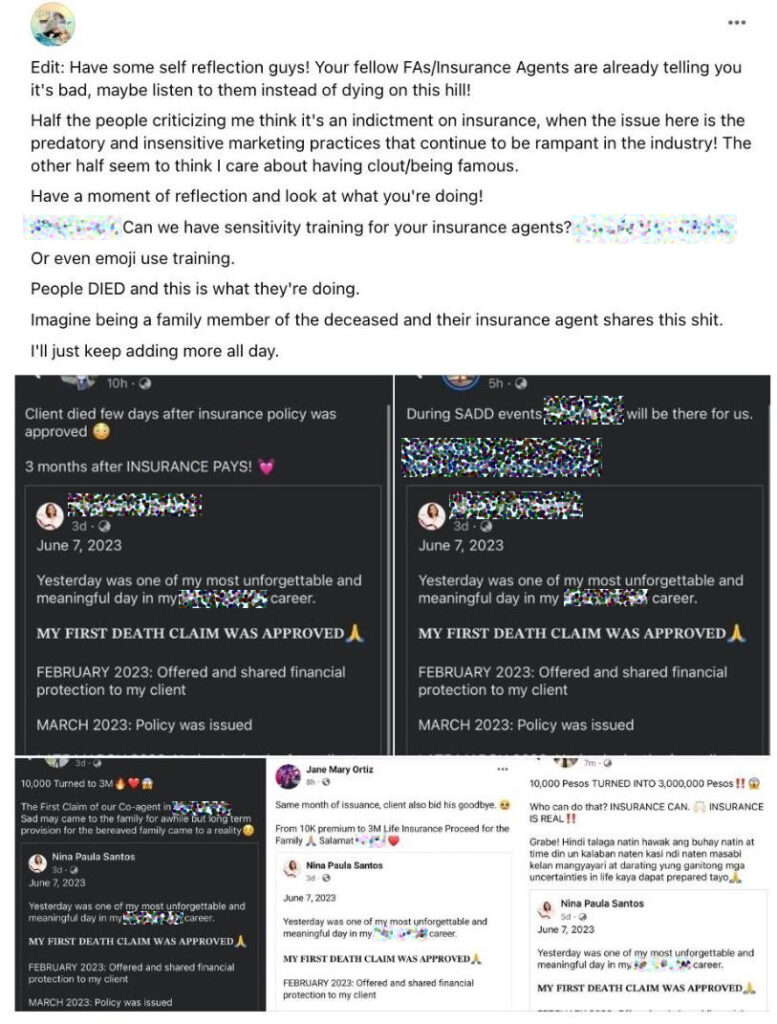

In a Facebook post last June 11, a Facebook user criticized some insurance agents for the way they market their insurance services. Based on the screenshots posted by the user, a financial advisor used the death of her client to promote her first-ever ‘death claim’ in her career. The post was later shared by other insurance agents who promoted insurance as well.

Our honest reaction upon reading this:

The user emphasized in his post that the issue was the “predatory and insensitive” marketing practices that remain prevalent in the insurance industry.

The user also urged the insurance company they’re associated with to conduct sensitivity training for their insurance agents. “People DIED and this is what they’re doing,” the user wrote in his post.

The Facebook post later gained a lot of attention and different reactions from other online users on the social media platform.

There were people who shared the same sentiment as the OP, saying that it was inappropriate to use a person’s death to market insurance and earn money. There were some who did not see anything wrong with the posts and said that the only intention of the financial advisor and insurance agents was to spread awareness.

Marketing and advertising are important in every business and company. Through these, they get to raise awareness about the products and services they provide. This is invaluable in boosting their profit and growth. However, looking back at the incident that was discussed, there is a need to question the marketing practices being employed by the agents–which, we’re highly assuming, are not among the cascaded talking points of the firm. We believe in what these agents are selling, there’s no doubt about it. Insurance coverage is important, and it is not up for debate. But perhaps we can call on the industry to examine the ways and means agents market these services to the public–perhaps a routine reminder to be ethical with their messaging and marketing?

Life insurance companies are there to inform people about the options they may take to prevent their families from suffering financial losses if they ever die. Insurance gives financial security for the future, which is without a doubt important for everyone to have. But using someone’s death as a way to market insurance, while not prohibited, is INSENSITIVE and will always be in poor taste, full stop. Just imagine situations being reversed–no one will want to be that anecdotal reference for how insurance is real with matching prayer emojis. It’s laughably unreal.

Again, there is nothing wrong with selling and marketing insurance. More Filipinos should have it. But for the love of God, market it responsibly and ethically. /VT

Other POP! stories that you might like:

If you haven’t yet, now’s probably the time to sort out your Personal Matters

Everyday objects’ names given a funny twist in this new Filipino meme format

Pan de Amerikana Katipunan branch to close up shop for good on June 30

Juan Luna’s long-lost painting finally unveiled after 132 years