The website of Department of Finance (DOF) features an online tax calculator tool that let’s you calculate how much of your salary can be saved if the proposed Tax Reform for Acceleration and Inclusion (TRAIN) program by DOF is approved for implementation in the Philippines. (Update: Congress has finally ratified the controversial tax reform measure.) According to DOF, the proposed tax reform program aims to put a tax system that is “simpler, fairer, and more efficient for all” while raising the necessary resources to cover infrastructure and other projects by the government.

The proposed new system also assures that the tax burden of the poor and the middle class will be lessened, which could be a welcome development for employees and workers in both private and government sectors.

DOF’s calculator also shows you where you can spend your saved tax money—either to short term things, such as a day in the spa or an out of town trip with the family, or for long term goals like adding more to one’s mutual fund investment or investing on a health plan.

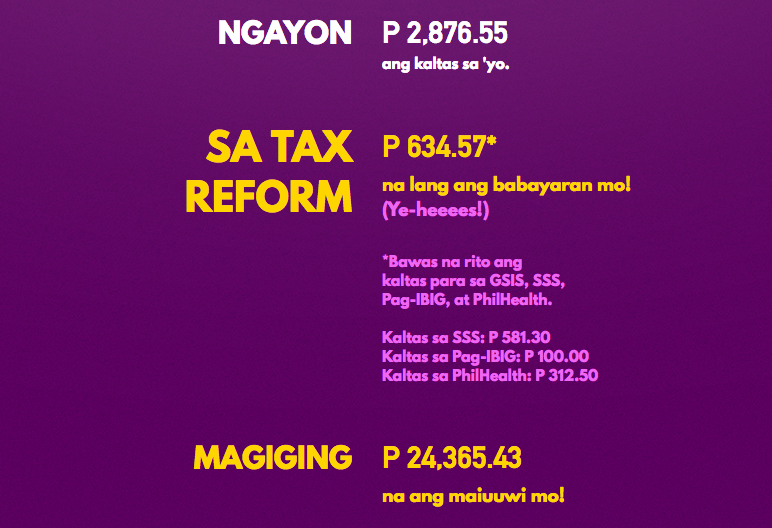

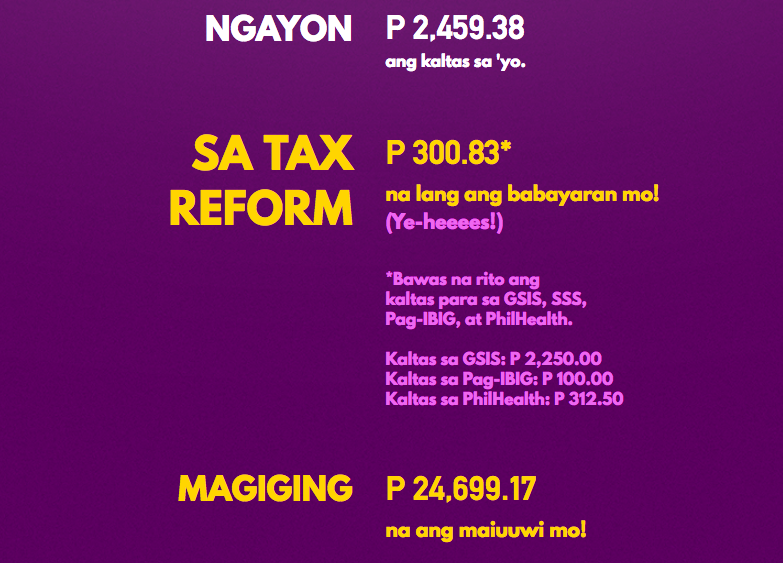

We tried our hand at calculating a salary, pegged at Php25,000 for single person with two dependents. Here’s what we got:

For private employees:

For government employees:

Fair enough? Let us know your thoughts in the comments below! Click or tap here to try the tax calculator.

/VT

Other stories you might like from InqPOP!:

Little boy rushing for dental work dressed as Annabelle gets the internet laughing

Women musicians react to sexual allegations against local indie bands

We bet you’ve never seen anything gayer than this “anti-LGBTQ” interpretive flag dance

Are you tough enough to endure this brutal tattoo?