Some people are now just too blunt about scamming others.

In the digital age, the convenience of online transactions has revolutionized the way we handle money. GCash, one of the leading mobile wallets in the Philippines, has become a staple for millions of users, offering a seamless way to pay bills, transfer money, and shop online. However, with the increasing reliance on digital transactions comes the rise of fraudulent activities, one of which is the sale of fake receipts.

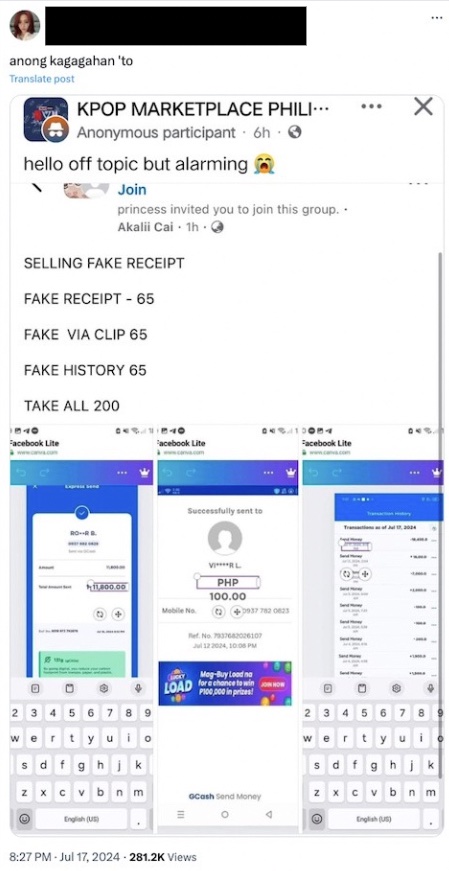

Viral today on various social media platforms are the alarming fake receipts available online, emerging as a significant problem in digital marketplaces.

These fraudsters offer services to generate counterfeit receipts that appear legitimate, fooling recipients into believing that a transaction has been completed. Using easily accessible graphic design tools and applications, they modify genuine receipt templates by altering transaction details such as the amount, date, and reference number. These fake receipts are then sold to individuals aiming to defraud others, assuming that those are sold often for a relatively low fee.

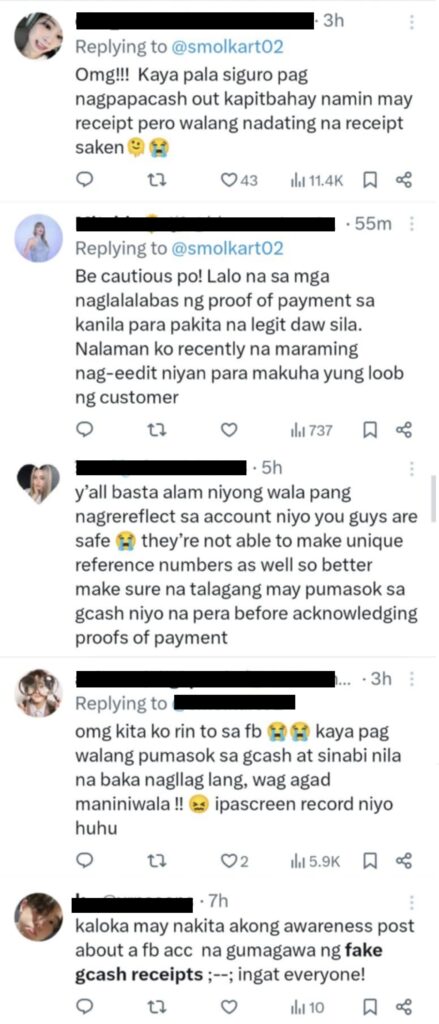

This illegal act has caught the attention of many social media users, voicing their concerns and saying that people should be extra cautious so they won’t fall victim to those scams.

Following the post, GCash has posted an official reminder to be wary of fake GCash receipts, further advising that users must always check their receipt’s legitimacy.

This fraudulent practice undermines trust in digital payments and poses a serious threat to both consumers and businesses. It poses far-reaching consequences, particularly for small and medium enterprises (SMEs) who fall victim to these scams, which can result in significant financial losses. Merchants who unknowingly accept fake receipts as proof of payment may ship goods or provide services without receiving any actual payment, directly impacting their bottom line.

Consumers are also at risk, especially those who conduct transactions with unknown parties online. Buyers can be duped into believing they have successfully made a payment, only to realize later that they have been scammed. This not only results in monetary loss but also damages the trust and credibility of digital transactions at large.

Creating and using fake receipts are considered fraud, which is punishable under Philippine law, and the alarming rise of fake e-wallet receipt sellers is a growing threat that undermines trust in digital financial transactions. As digital payments continue to play a crucial role in the Philippine economy, it is imperative to address this issue with urgency.

The fight against digital fraud is a collective effort that requires vigilance and proactive measures from every stakeholder involved.

Other POP! stories that you might like:

Filipino artist raises alarm on AI’s role in art, advocates for artists’ rights

Influencer criticizes BINI members for wearing masks and hats in public, gets mixed reactions

‘Eyyy ka muna Eyyy:’ The context behind this playful phrase that’s taking over social media

Opinions fly as Abegail Rait shares cryptic quote amid backlash over daughter’s ‘club’ video