Sari-sari stores are distinctly Filipino and are part of every community’s way of living. You can find one in every neighborhood and in almost every street. It is a common practice for low-income families to amend their monthly budget by setting up a small store in their home, right by a small window where they can transact with customers. It is also a convenience for everyone, especially those living in far flung villages, because they can buy what they need without having to go far from their homes. And where else will you be able to buy things like shampoo sachets, candies, and small snacks by “tingi”? As our National Artist Nick Joaquin said in one of his essays:

“What most astonishes foreigners in the Philippines is that this is a country, perhaps the only one in the world, where people buy and sell one stick of cigarette, half a head of garlic, a dab of pomade, part of the contents of a can or bottle, one single egg, one single banana. To foreigners used to buying things by the carton or the dozen or pound and in the large economy sizes, the exquisite transactions of Philippine tingis cannot but seem Lilliputian.” (excerpt from Nick Joaquin’s “A Heritage of Smallness”)

Though the idea of sari-sari stores may be surprising for foreigners, it is so much a part of our daily lives. This is especially true for the majority of Filipinos who cannot afford to buy necessities in bulk or have no need for such and thus rely on these micro-enterprises for their daily needs. Low-income families, minimum wage earners, blue collar workers, even students—all these people regularly purchase from sari-sari stores. Imagine, then, how these people will be affected by a bill that is putting small stores at risk.

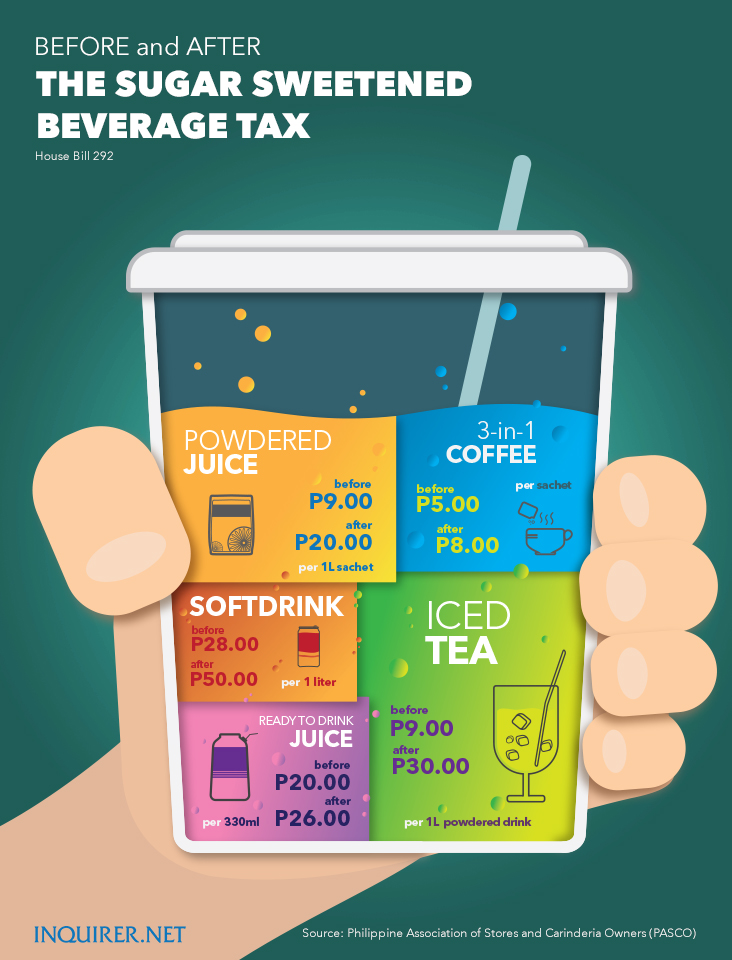

A recent proposal for tax reform from Congress is putting 1.3 million sari-sari stores across the country under the likelihood of losing profit. The Sugar Sweetened Beverage Tax (SSB Tax) or House Bill 292 imposes an increase P10 to P20 in the prices of common sweetened beverages like instant coffees, powdered juices, and energy drinks. The bill was originally proposed to help raise funds for the rehabilitation efforts after Yolanda in 2013, but has now been included in the Tax Reform for Acceleration and Inclusion (TRAIN) of the government.

Just how much additional charge are we talking about? Here’s a chart:

The tax imposed by this bill on sweetened beverages will be adjusted once every three years “through rules and regulations issued by the Secretary of Finance after considering the effect on the same of the three-year cumulative CPI inflation rate,” as stated in Section 26 of H. No. 5636 (TRAIN).

According to a survey conducted by AC Nielsen and re-confirmed by the Philippine Association of Stores and Carinderia Owners (PASCO) during the Senate hearing last June 15,2017, 40% of a small store’s earnings comes from these beverages. Once the prices of these drinks get higher, the people who normally buy them will no longer be able to afford them, which will result to store owners losing profit and not being able to support their families.

While sari-sari store and carinderia owners are going to suffer the brunt of the hit once the beverage tax is rolled out, it will also affect the common Filipino who consumes these products.

Based on a retail survey by AC Nielsen, 80% of sweetened beverages consumers are low-income earners. PASCO has expressed their sentiment that minimum wage earners, who will not benefit from the lower income taxes being proposed in the tax reform, will be even more burdened by the excise tax they would have to pay for in these beverages.

The Makabayan bloc in Congress, who voted against the tax reform, has called the bill “anti-poor” because the imposition of excise taxes would have a domino effect on the prices of basic goods, thereby defeating the purpose of lowering income taxes to increase the take-home pay of workers. Despite this, Congress has approved the tax reform package on its final reading last May 31, 2017.

PASCO continues its efforts to save sari-sari store and carinderia owners from the SSB Tax as the Senate conducts its hearings about the tax reform.

“Naiintindihan namin na kailangan ng ating gobyerno ng pera upang pondohan ang mga proyektong para sa mahihirap. Ngunit panawagan namin na huwag naman sanang sa mahihirap din kunin ang pondo para dito,” PASCO President Vicky Aguinaldo stated in her speech in the Senate hearing.

PASCO is still gathering signatures for an on-ground and online petition against the SSB Tax. As of July 10, they have garnered around 207,424. You can sign the petition here.